Product Description

Simplify EU export operations with CBAM Reporting Accounting Services

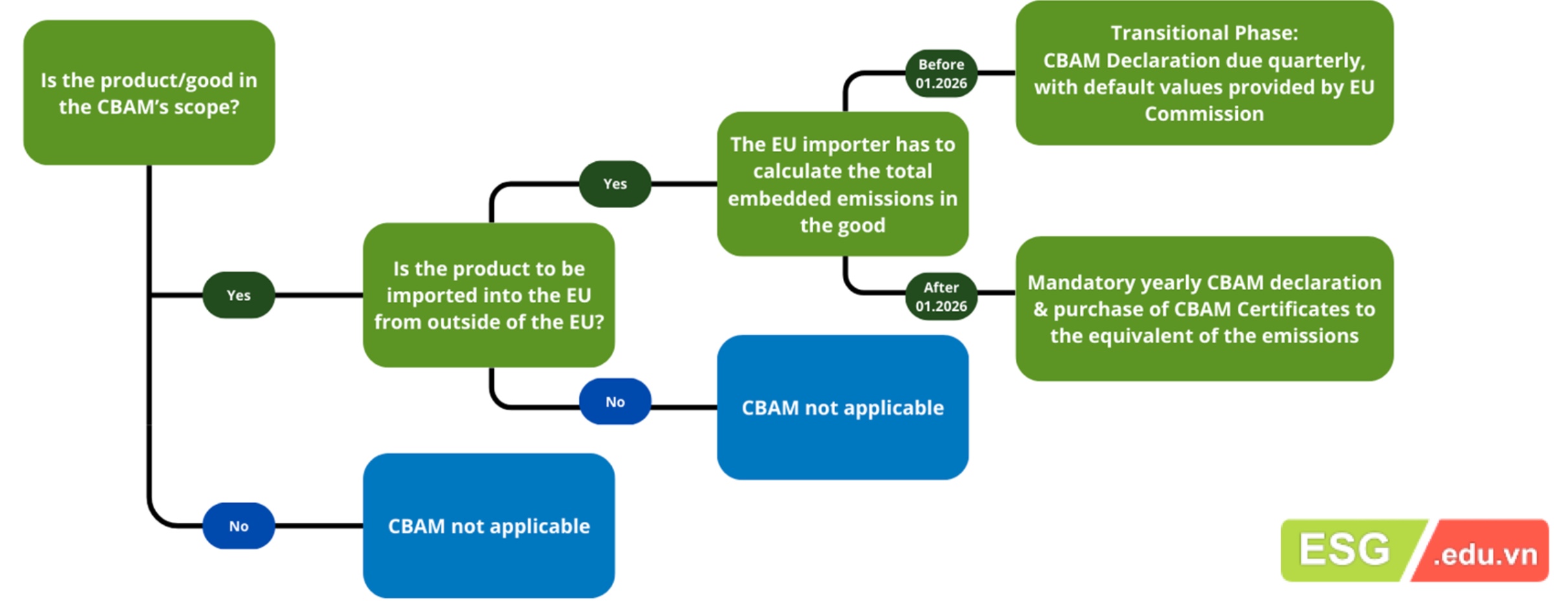

The Carbon Border Adjustment Mechanism (CBAM) regulates trade between non-EU countries and the European Union, focusing on high carbon-emitting industries. If your business is involved in sourcing from companies outside the EU or exporting to the EU, particularly in sectors such as cement, iron and steel, aluminium, fertilisers, electricity and hydrogen , the CBAM will have a direct impact on your operations.

1. Responsibilities of exporters to the EU:

– Providing carbon emissions data: Manufacturers and exporters from outside the EU are required to collect and provide detailed data on the CO2 emissions associated with the production of products exported to the EU. This data must be transparent and accurate.

– Cooperation with importers: Exporters need to cooperate closely with importers within the EU to provide adequate documentation to demonstrate product emissions, especially when importers require them to fulfill their reporting responsibilities.

– Improve production processes: To reduce the burden of CBAM, manufacturers may have to improve technology and reduce emissions in the production chain to reduce the number of CBAM certificates that importers have to purchase.

2. Responsibilities of importers to the EU:

– Reporting of emissions of imported goods: Importers to the EU are responsible for reporting the carbon emissions associated with the goods they import into the EU market. This must be done annually and the report must include accurate information on the product’s emissions.

– Purchase of CBAM certificates: To offset the carbon footprint of goods, importers must purchase the corresponding CBAM certificates. Each certificate represents one ton of CO2 emitted during the production of the product. The price of these certificates will fluctuate according to the carbon price in the EU ETS (EU Emissions Trading System).

– Annual reporting and CBAM compliance: Importers must submit annual reports on the quantity of imported goods and related emissions, and pay the required number of CBAM certificates.

3. Both exporters and importers need:

– Monitoring emissions regulations and standards: Understanding EU carbon emissions standards and the phased implementation of CBAM is crucial to ensure compliance.

– Prepare an emissions reporting system: Both exporters and importers need to have a system to accurately calculate and report emissions, and be transparent in managing emissions from the supply chain.

In our last article , we highlighted that the European Union is urging companies to adopt CBAM and assess the CO2 emissions generated by their non-EU suppliers. Many businesses find this challenging due to a lack of the right tools and resources to meet these requirements.

CBAM Reporting is a quick and simple solution for:

For EU companies importing from outside the EU:

ESG Education & Business together with Normec offers a simple solution, providing tools to help your suppliers calculate and report their CO2 emissions easily.

For non-EU companies exporting to the EU:

ESG Education & Business together with Normec provides a quick and simple way to generate the necessary emissions data your EU buyers need for CBAM reporting.

ESG Education & Business’s solution: CBAM Reporting accounting service for Vietnamese companies exporting to the EU

Under CBAM, non-EU companies exporting cement, steel, aluminium, fertilisers, electricity and hydrogen to the EU must report their CO2 emissions during production.

The CBAM Portal reporting questionnaire provides a simple, user-friendly tool to calculate and understand your company’s CO2 emissions related to these products.

This solution not only allows you to report and share your emissions data with EU supply chain partners, but also positions your company for a competitive advantage. By being proactive in emissions reporting, you make your business more attractive for future transactions with EU buyers, especially compared to companies that have not yet taken this step.

Collecting and reporting this data can quickly become a complex challenge without a comprehensive, globally available tool.

Our services provide:

– Support for creating reporting accounts.

– Comprehensive customer support to properly report the necessary information.

– Dashboard to analyze and calculate CO2 emissions from your supply chain.

Be a leader and gain a significant competitive advantage by adapting to new regulations before your competitors.

In addition, ESG Education & Business is a strategic partner of Normec Verifavia and Normec QS to provide CBAM Reporting Audit services.

Normec ’s CBAM Reporting Audit service is designed to help businesses fully comply with the regulations of the Carbon Border Adjustment Mechanism (CBAM) issued by the European Union (EU). This is an important tool in the EU’s greenhouse gas emission reduction strategy, requiring businesses exporting items such as iron and steel, cement, fertilizer, aluminum, electricity, hydrogen, etc. to the EU market to declare and submit data on carbon emissions during the production process.

As an independent assessment and verification body, Normec provides a comprehensive audit of CBAM reports in accordance with the technical guidelines and templates published by the European Commission. The audit process includes:

- Verify input data such as raw material quantity, energy consumption, CO₂ emission data corresponding to each product line;

- Compare with emission factors and standard calculation method according to CBAM ;

- Check the enterprise’s measurement – reporting – verification (MRV) system ;

- Assess compliance with EU technical criteria , including direct and indirect emissions allocation methods, product quantities, and manufacturing plant information.

Normec combines extensive technical expertise with practical experience in greenhouse gas auditing, MRV and carbon market mechanisms. Normec’s services not only ensure the accuracy and transparency of CBAM reports, but also support businesses to minimize the risk of returns or administrative fines , while enhancing their reputation and competitiveness when accessing the EU market. With a global network of operations and an internationally accredited inspection system, Normec is a trusted partner for Vietnamese and regional businesses aiming for green and sustainable exports.

When customers work with CBAM Reporting accounting service, they will be assured of comprehensive support from the steps of report execution, auditing, and submitting to CBAM Portal in the fastest way.

ESG EDUCATION & BUSINESS CAPABILITIES

You can contact us to perform CBAM Reporting via email inquiry@esg.edu.vn or +84988 203 940

)

Reviews

There are no reviews yet.